LOP

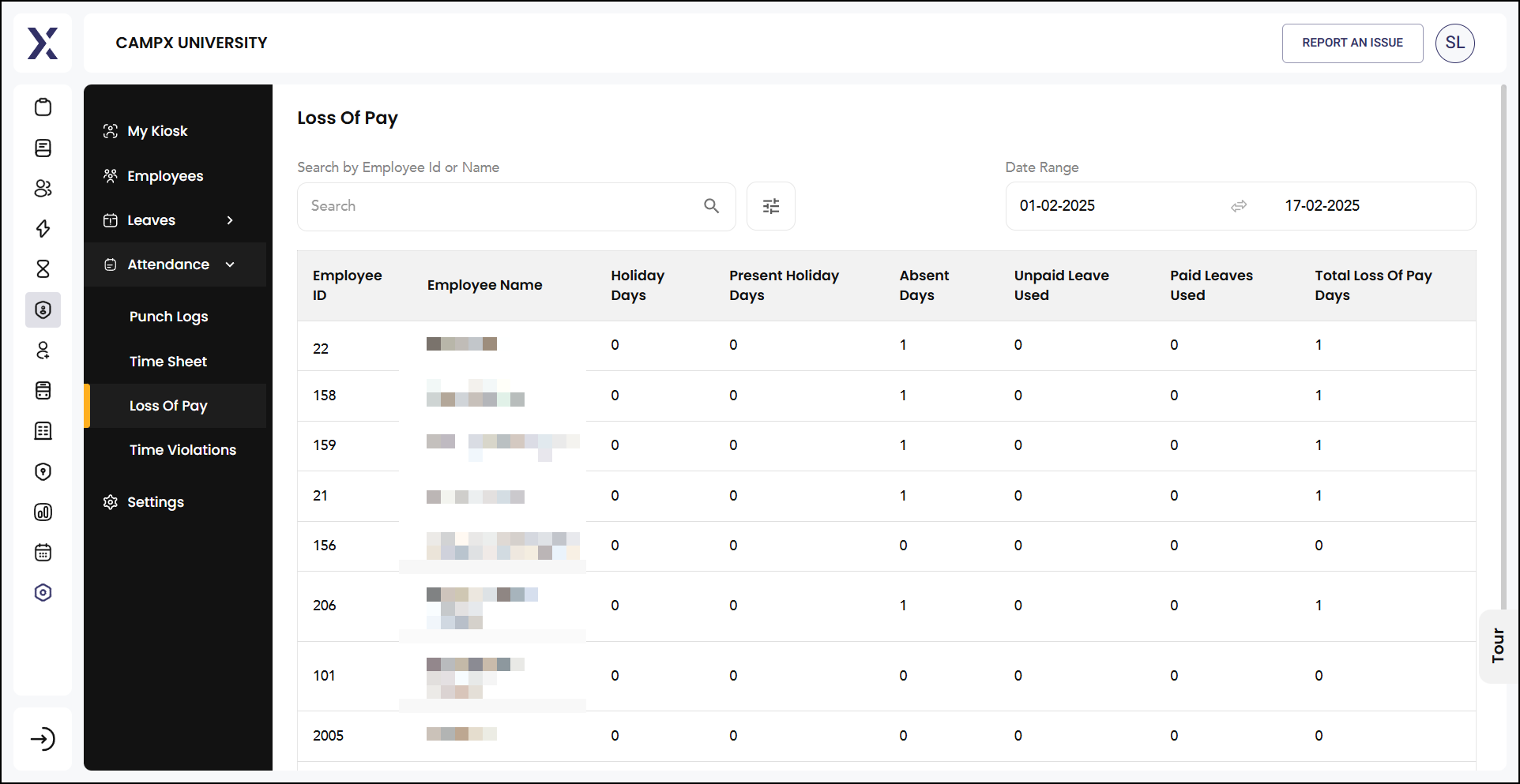

Loss of Pay (LOP) refers to the deduction in an employee's salary for days they were absent without paid leave. This can occur due to reasons such as unauthorized absenteeism or exceeding the allotted paid leave days. Essentially, it means that the employee will not receive compensation for the days they did not work and were not on approved paid leave.

LOP has a direct impact on the take-home pay of an employee and can affect various other components of payroll processing. Ensuring accurate tracking and processing of LOP days is vital for maintaining financial accuracy and compliance.

thus

This section helps in tracking and managing the attendance records of employees, and it is crucial for processing payroll accurately.